Asia Jetline: Your Gateway to the Skies

Explore the latest trends and news in the aviation industry across Asia.

Trade Reversal Timeline CS2: When the Market Decides to Switch Gears

Discover the key moments that trigger market reversals in CS2. Uncover secrets to spot trends and maximize your trading strategy today!

Understanding Trade Reversals: Key Indicators and Timing in CS2

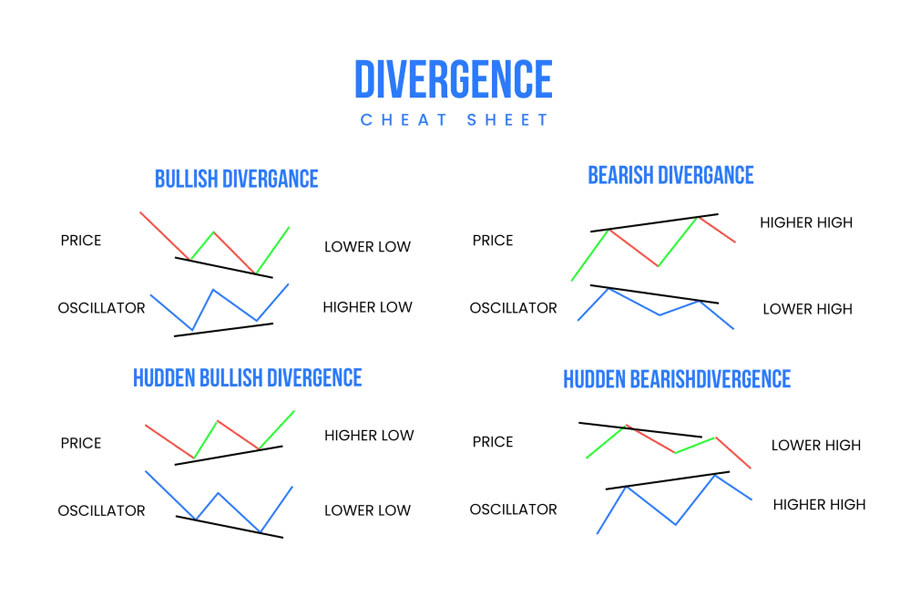

Understanding trade reversals in CS2 is crucial for traders looking to maximize their profitability. A trade reversal occurs when a security's price changes direction, signaling that the prevailing trend is losing momentum. Key indicators to watch for include moving averages, which can highlight potential reversals through crossovers, as well as RSI (Relative Strength Index) readings that fall below 30 (indicating oversold conditions) or rise above 70 (indicating overbought conditions). By closely monitoring these indicators, traders can gain valuable insights into the timing of potential market shifts.

Additionally, volume analysis plays an essential role in identifying trade reversals. High trading volumes accompanying a price reversal may suggest strong buyer or seller interest, enhancing the validity of the reversal. Furthermore, consider using chart patterns, such as double tops or bottoms, which can provide visual cues of an impending reversal. To improve trading effectiveness, combine these indicators with a consistent risk management strategy that includes setting stop-loss orders. This approach not only helps in pinpointing optimal trade entry and exit points but also minimizes potential losses in volatile market conditions.

Counter-Strike is a popular tactical first-person shooter that emphasizes teamwork and strategy. Players join either the terrorist or counter-terrorist team, with the objective varying from bomb planting to hostage rescue. For players looking to enhance their gameplay experience, understanding the economy and trading skins is crucial. If you're interested in trading, you might want to learn how to reverse trade cs2 to make the most out of your inventory.

How to Identify a Market Gears Change in CS2: Tips and Strategies

Understanding how to identify a market gears change in Counter-Strike 2 (CS2) is crucial for players aiming to stay ahead of the competition. One effective strategy is to monitor the in-game economy closely. Pay attention to pricing trends and how they fluctuate with the introduction of new skins or weapon updates. A sudden increase in the demand for a particular item may indicate a shift in the market landscape. Utilize tools such as market trackers and community forums to gather insights and engage with other players who share valuable information.

Additionally, leveraging social media platforms and dedicated CS2 forums can provide real-time updates on market sentiments. For instance, keep an eye on platforms like Reddit or Discord, where players often discuss rumors, leaks, or tips about changes in the game that could affect the market. Being proactive about gathering information can give you a competitive edge. Lastly, evaluating player behavior during events or tournaments can also hint at upcoming shifts in the market, allowing you to make informed decisions quickly.

What Causes Trade Reversals in CS2? Exploring Market Dynamics

Trade reversals in CS2 can be attributed to a multitude of market dynamics. One primary factor is the fluctuation of player behavior and sentiment, which often leads to rapid shifts in demand. For instance, significant updates or changes in the game's mechanics can influence player preferences, causing them to buy or sell items at unexpected rates. Market sentiment can be amplified through social media and community platforms, where players share their experiences and predictions, thus driving the trade patterns further.

Another crucial aspect that causes trade reversals is the imbalance between supply and demand. Factors such as limited edition items, promotions, or seasonal events can temporarily disrupt the market equilibrium. Additionally, the introduction of new content often leads to a spike in supply, which, if not met with consistent demand, will inevitably lead to price corrections and reversals. Understanding these trends is essential for traders who wish to make informed decisions and capitalize on the ever-changing dynamics of the CS2 market.