Asia Jetline: Your Gateway to the Skies

Explore the latest trends and news in the aviation industry across Asia.

Why Renters Insurance Is Like an Umbrella on a Sunny Day

Discover why renters insurance is your safety net—just like an umbrella on a sunny day! Protect yourself before it's too late!

The Unseen Protection: How Renters Insurance Safeguards Your Belongings

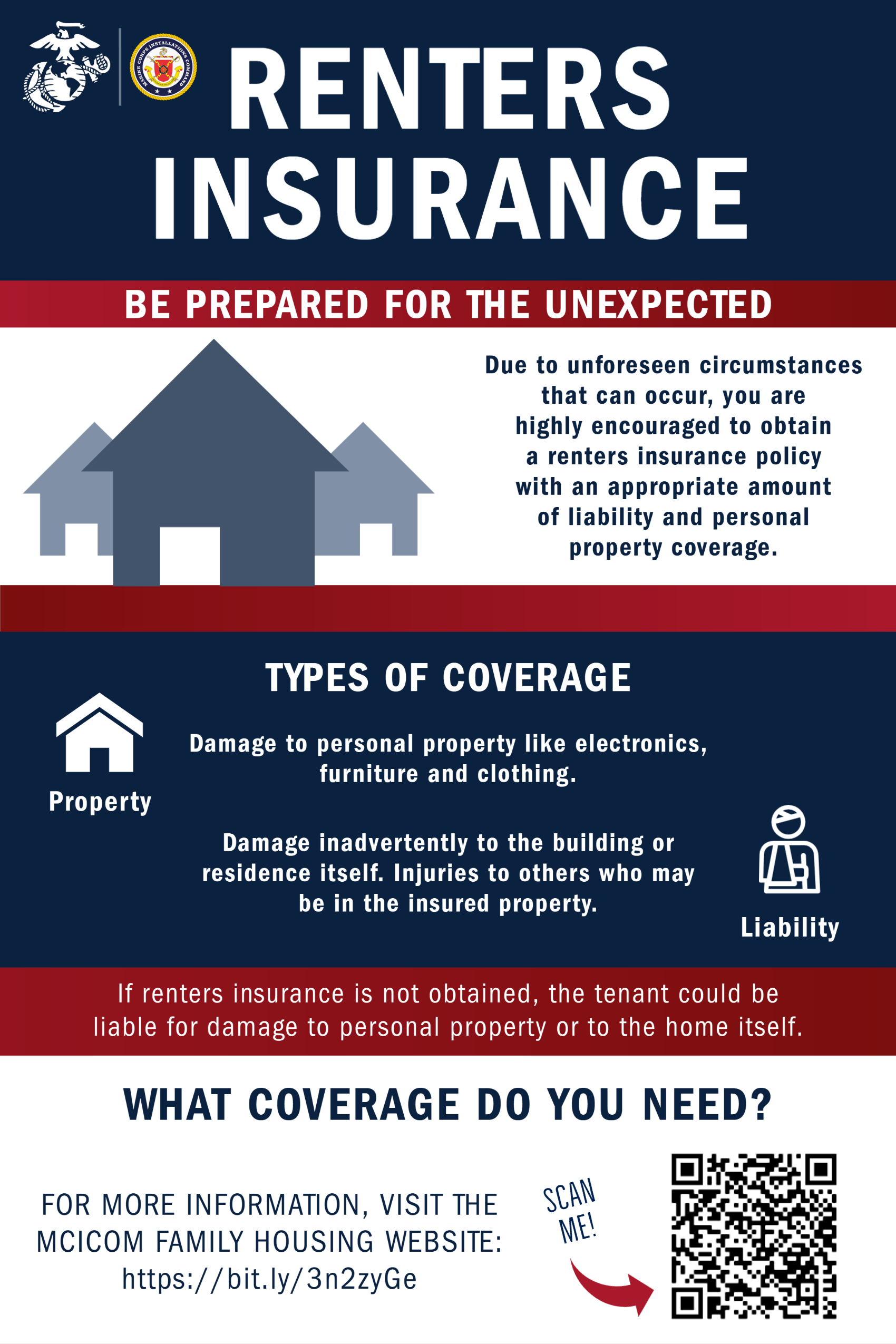

Renters insurance is often overlooked by tenants who believe that their landlord's policy covers their personal belongings. However, this is a common misconception. In reality, renters insurance provides essential protection for your possessions in case of events such as theft, fire, or water damage. Imagine losing your valuable electronics, furniture, and clothing without any form of compensation. With renters insurance, you can safeguard your belongings and ensure that you're financially covered in unfortunate situations. It is a modest investment that offers peace of mind, knowing that your personal items are protected.

In addition to protecting your belongings, renters insurance often includes liability coverage, which can be crucial in case someone gets injured in your rented space. This coverage helps you cover legal fees and medical expenses, preventing potentially devastating financial repercussions. Furthermore, many policies also provide additional living expenses if your home becomes uninhabitable due to a covered peril. This can include temporary lodging and other essential living costs. By choosing renters insurance, you’re not just protecting your belongings; you’re also ensuring that you have a safety net in case life throws unexpected challenges your way.

Is Renters Insurance the Umbrella You Didn't Know You Needed?

When it comes to protecting your belongings, renters insurance is often underestimated. Many tenants believe that their landlord's insurance policy will cover them in the event of a disaster, but this is a common misconception. Landlords typically only insure the building itself, leaving tenants vulnerable to potential loss. Without renters insurance, valuable possessions, such as electronics, furniture, and personal items, can be lost forever in instances of theft, fire, or water damage. By investing in this inexpensive coverage, you gain peace of mind knowing that your belongings are shielded from unforeseen circumstances.

Furthermore, renters insurance can provide liability coverage as well, acting as a financial umbrella that you didn't know you needed. If a visitor injures themselves in your rented space or if accidental damage occurs to someone else's property, this policy can help cover legal fees and related expenses. Without such protection, you may find yourself facing significant financial burdens. In today's unpredictable world, having renters insurance could make all the difference, safeguarding both your assets and your financial future.

Why You're Better Off With Renters Insurance—Even When the Sun is Shining

Renters insurance is often perceived as an unnecessary expense, especially when everything seems to be going well. However, this type of insurance acts as a safety net, protecting your belongings against unexpected events like fire, theft, or natural disasters. Even when the sun is shining and life's going smoothly, having a policy ensures that you're not left in a vulnerable position if something were to go wrong. Imagine returning home to find that a burst pipe has flooded your apartment, destroying your electronics and personal items. Without renters insurance, the financial burden to replace these essentials would fall solely on you.

Moreover, renters insurance offers liability coverage, which can be invaluable in the case of accidents. If a friend gets injured while visiting your home, you could be held responsible for their medical expenses. This coverage protects you from potentially crushing liability costs that can arise from such incidents, providing peace of mind even on calm days. In essence, investing in renters insurance is a small price to pay for substantial protection—it safeguards not only your belongings but also your financial future.