Asia Jetline: Your Gateway to the Skies

Explore the latest trends and news in the aviation industry across Asia.

Insurance for the Uninsurable: When Life Throws You a Curveball

Discover how to navigate life's unexpected challenges with insurance options for the uninsurable. Don't let the curveballs win!

Understanding High-Risk Insurance Options: A Guide for the Uninsurable

Understanding high-risk insurance options is essential for individuals who may find themselves classified as uninsurable. This classification often applies to those with pre-existing medical conditions, a history of significant claims, or risky professions. Conventional insurers may shy away from providing coverage due to the perceived financial risk, leading these individuals to seek alternative solutions. Thankfully, multiple high-risk insurance products exist that cater specifically to those in difficult situations. It's important to explore these options thoroughly to find the right coverage that meets your needs.

The following are key types of high-risk insurance options that can assist individuals who may struggle to obtain traditional policies:

- Specialty insurers: These companies focus on niche markets and often accept clients that standard insurers would deny.

- High-risk pools: Many states have established insurance programs that pool high-risk individuals to spread the financial burden across a larger group.

- Excess coverage: This option provides additional coverage above and beyond your existing policies, which can be beneficial in managing liabilities.

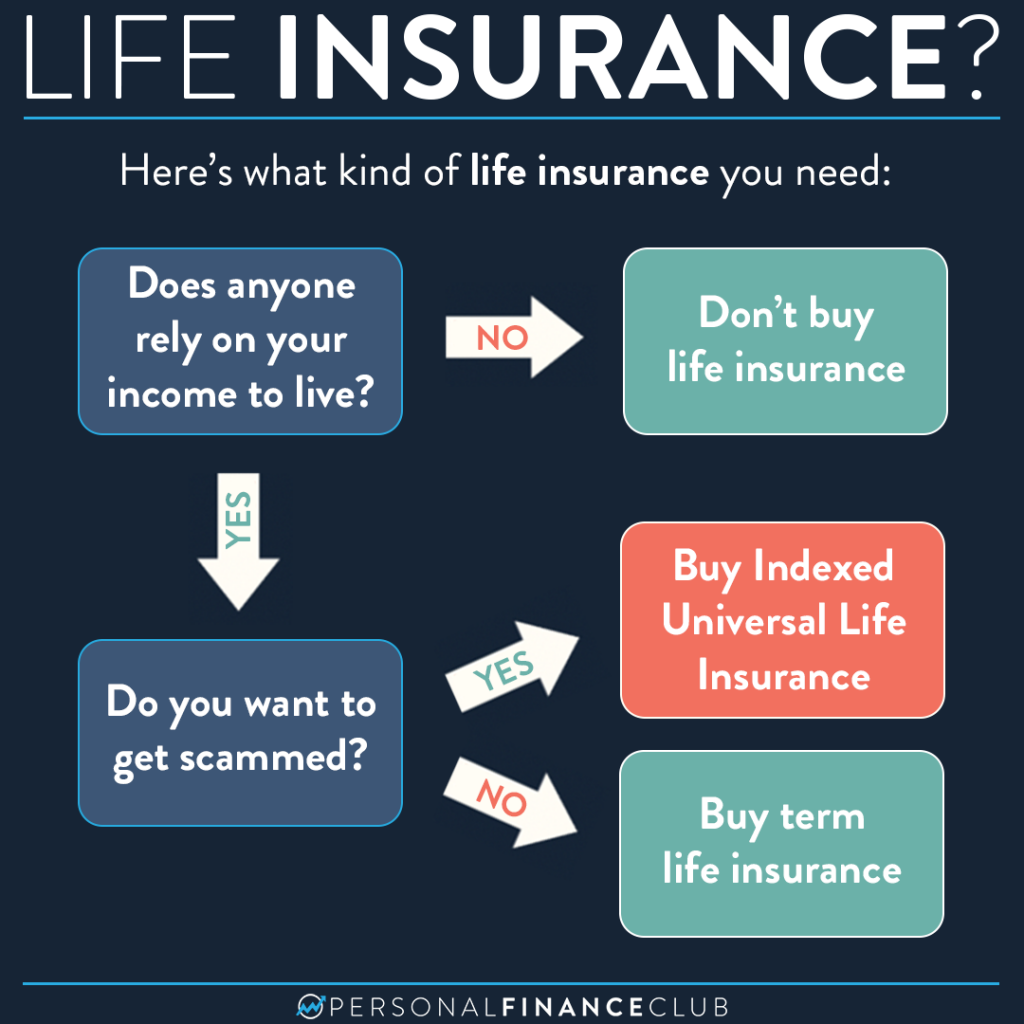

How to Navigate Life Insurance When Traditional Options Aren't Available

Navigating life insurance when traditional options aren’t available can feel daunting, but understanding the alternative routes can empower you. Begin by exploring guaranteed issue life insurance, a policy that typically doesn’t require medical exams or health inquiries. It’s perfect for individuals with pre-existing conditions or older adults who may find it challenging to qualify for standard coverage. Additionally, consider final expense insurance, designed to cover burial costs and other end-of-life expenses, allowing for a more straightforward application process.

Another avenue to consider is group life insurance, often provided through employers or associations. This option can simplify the process since you usually won’t need to undergo health screenings. If you're self-employed or ineligible for group plans, look into modified whole life insurance, which offers a cash value component while being more accessible to those with health concerns. Lastly, consult with an insurance broker who specializes in high-risk policies; they can guide you through your choices and help you find a suitable plan tailored to your needs.

What to Do When You're Denied Coverage: Exploring Alternatives for the Uninsurable

Being denied coverage can be a frustrating experience, especially when it feels like you have no options left. If you've recently received a denial from your insurance provider, it’s important to assess why your coverage was denied. Common reasons may include pre-existing conditions, age, or a history of high-risk behavior. In such cases, consider alternative options like seeking quotes from different insurers, many of which may have more lenient underwriting guidelines. Joining a group plan, such as one offered by a professional organization, can also be a viable route to explore.

If traditional insurance avenues are closed to you, don’t despair. There are still plenty of alternatives for the uninsurable. Options include high-risk pools, which are specific programs designed to provide coverage to individuals facing challenges in obtaining insurance. Additionally, consider exploring short-term health insurance plans that can offer temporary solutions while you work towards a more permanent resolution. Remember to consult with an insurance broker who can help navigate these complex waters and present you with various options tailored to your situation.